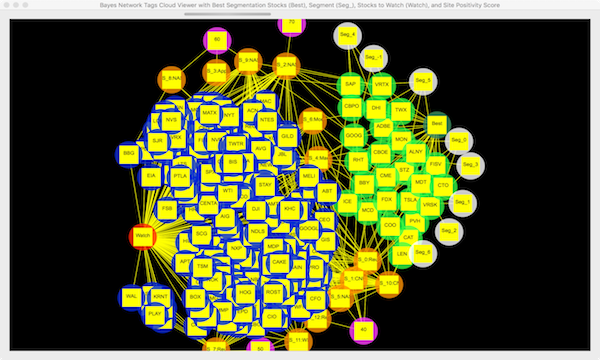

On June 30, 2017, AroniSmartInvest In Action™ picked, leveraging the proprietary advanced Text and Sentiment Analytics, Stock Segmentation, and Machine Learning, a few promising stocks to watch over July and August 2017. Below is a quick overview of some of these stocks, with a focus on the information in news, social media, and other sources leveraged by AroniSmartInvest machine learning and stock segment module:

- SAP: SAP SE. (NYSE: SAP).SAP will release earnings on July 19, 2017. Analysts forecast an increase of EPS to $1.03, up $0.27 or 35.53 % from last quarter's $0.76 EPS. SAP SE is a software and service provider, offering enterprise application software. Its forecasted performance is mostly attributed to its improved cloud services offerings.

- DHI: D.R. Horton, Inc.. (NYSE:DHI)is a homebuilding company. Austin-based D.R. Horton Inc. recently acquired Forestar Group Inc. in a $560 million majority acquisition bid, outbidding a rival offer from the Starwood Capital Group. TWX Time Warner Inc recently invested $100 Million in Snapchat Shows. Such investments in social media and digital may have led pushed Time Warner stock (TWX) to attain new 52-Week High.

- ADBE: Adobe Inc . has mastered software and web design industry with its Adobe Creative Suite software and has pushed into cloud services and digital analytics. Adobe's revenues have reached a record growth in Q2 2017.

- AAPL: Apple Inc. see AroniSmartInvest in Action.

- MON: Monsanto Company. (NYSE:MON)Ex-Dividend date is scheduled for July 05, 2017, with a cash dividend payment of $0.54 per share to be paid on July 28, 2017. Its revenues growth has been fueled by sales of soybean seed and traits, the company's second-biggest business by revenue. The sales jumped 29.3% to $896 million in the third quarter that ended on May 31, 2017. Monsanto agreed, in September 2016, to a $66 billion buyout offer from Bayer AG. The merger is expected to be completed by the end of 2018

- ALNY: Alnylam Pharmaceuticals, Inc (NYSE:ALNY is a biopharmaceutical company. It recently announced positive clinical results for Givosiran. Shares were recently down on profit taking, including from executives, after more than doubling since Q1.

- WMT: Wal*Mart (NYSE: WMT) sales get boost from online growth, customer visits. The pick up in shopping activity, boosted by its e-commerce presence, is expected to fendoff stiff competition, in the short term. Its E-commerce grew at an impressive 63% YOY this quarter in the U.S., a significant improvement from 29% last quarter and 21% in fiscal 4Q17.

- STZ: Constellation Brands Inc (NYSE:STZ) is an international producer and marketer of beverage alcohol brands. The company released first-quarter fiscal 2018 results, with adjusted earnings of $2.34, above the Zacks Consensus estimate of $1.98.

- BBY: Best Buy Co. (NYSE:BBY) shares rose 14% in May 2017. Overall revenue also increased slightly from $8.4 billion to $8.5 billion.

- MCD: McDonald’s Corporation (NYSE MCC) (NYSE:MCD) is trading at 152.50, as of Monday July 3, 2017, with a 1 year low of $110.33 and a 1 year high of $155.46. In April, McDonald’s Corporation posted $1.47 EPS for the period, reaching the Zacks’ average forecast of $1.33 by $0.14, with reported sales of $5.68 B for the period end, beating the average forecast of $5.53 B.

- FDX: FedEx Corporation (NYSE: FDX) acquired, one-year ago, the European freight company TNT Express. TNT has added $7.4 billion of revenue to Federal Express during fiscal 2017,or 15% of FedEx's prior-year total revenue. Analysts have FedEx's EPS growing 11% to $13.64 in 2018 and then 14% to $15.55 in 2019.

- TSLA: Tesla Inc (NYSE: TSLA) stock has been declining slightly in recent weeks, after a strong momentum since the beginning of the year. Model S and Model X deliveries Year-over-year growth is estimated at 53%. However, vehicle sales were down 12% compared to the first quarter of 2017. The stock may be perceived as highly priced, but may continue its momentum if Tesla Inc, resolves its battery production issues.

- PVH: PVH Corp (NYSE: PVH). is an apparel company, operating through three segments: Calvin Klein, Tommy Hilfiger, and Heritage Brands. PVH Corporation posted first-quarter fiscal 2017 results. Adjusted EPS increased 10% year over year to $1.65, beating the Zacks Consensus Estimate of $1.61. Total revenue increased 3.7% to $1,989 million, surpassing the Zacks Consensus Estimate of $1,955.4 million

- CAT: Caterpillar Inc. (NYSE: CAT) is a manufacturer of construction and mining equipment. It has benefited from the increased demand for construction equipment from international markets. Asia-Pacific and Latin America remain its areas of strong demand. Caterpillar reported 52% and 9% growth in sales, respectively, from the two regions for the three months ending May 31, 2017.

- COO: The Cooper Companies Inc (NYSE:COO) reported adjusted earnings of $2.50 in the second-quarter of fiscal 2017, above the Zacks Consensus Estimate by $0.25 and improved from $2.05 in the year-over-year. Revenues increased to $522.4 million from $483.8 million in the prior-year quarter, and above the Zacks Consensus Estimate of $520 million.

- LEN: Lennar Corporation (NYSE:LEN) is a provider of real estate related financial services, commercial real estate, investment management and finance company. In mid June, Lennar announced the plan to build homes integrated with Amazon Alexa, the first homes to be “Wi-Fi certified” with automation and voice control by Amazon Alexa. Since then, the average 1-year target price among brokerages that have covered the stock in the last year has been set to $55.40, above the current share price of around $53.00.

- WFM: Whole Foods Market. see AroniSmartInvest in Action.

- WMT: Wal*Mart. see AroniSmartInvest in Action.

Disclaimer: AroniSmart Team members and/or AroniSoft LLC have investments in the following stocks: WFM, WMT, MON, and AAPL and may buy other stocks mentionned in this article in the short term.