News Feed

-

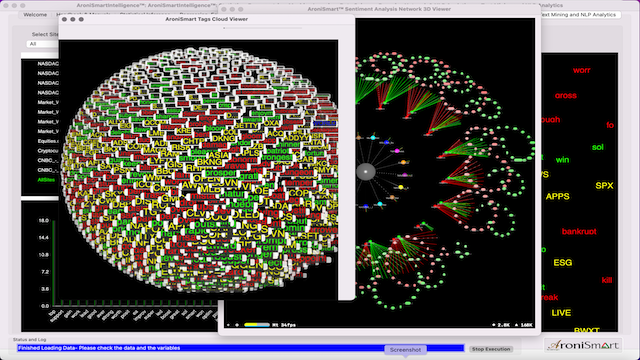

AroniSmartIntelligence⢠and AroniSmartInvest⢠Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks in Mid Q2 2024

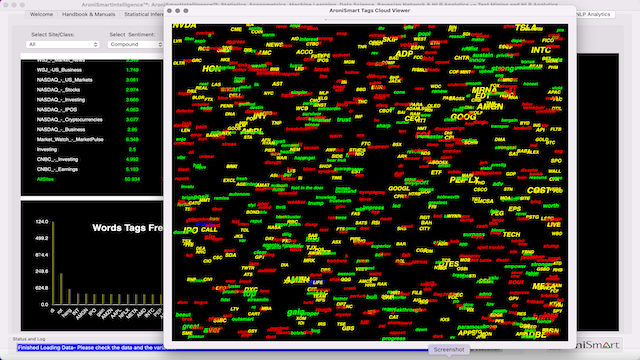

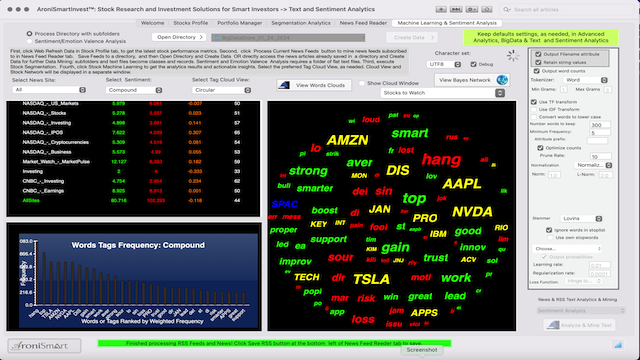

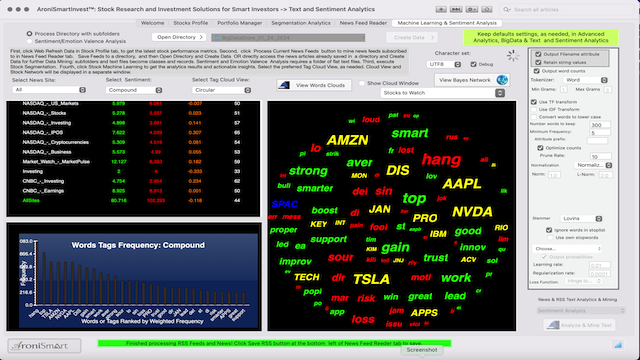

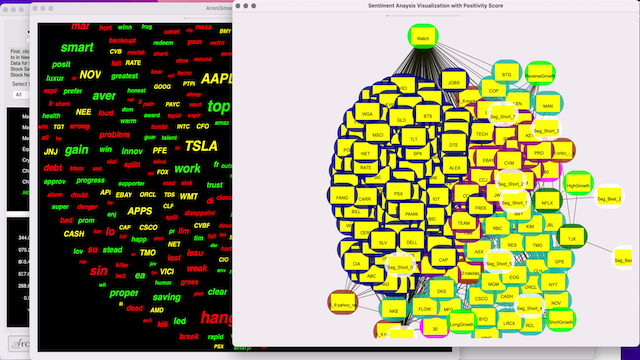

In Q2 2024, Stocks across industries  have continued to experience, yet an unprecedented upward momentum. The momentum built on  the dynamics of Q1 2024. Hence, the market has continued to reinforce the foundation of  Q4 2023, which overtook the challenges at the end of Q3 2023, when all the key market indices, excluding Crude Oil (CL=F) and 10-Yr Bond (^TNX), declined from the top reached  in late July 2023. By mid Q2 2024, the gains observed in Q1 2024 continued to increase.  The positive momentum appears to continue  to be driven by the diminishing challenges, which led to the stocks and indices pushing through  Q1 2024 with a significant improvement in performance.  Hence,  since Q4 2023, the stock market  adjusted to the previous  dynamics that have been leading to increasing market volatility, includinginflation, world events, and other challenges that started in late Q2 2022 and in October 2023.  The US elections in 2024  continue  to have a limited  impact on  the dynamics. Hence, the performance  and factors from the end of year 2024 remain the main drivers.  On March 25, 2024, AroniSmart⢠team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ⢠and AroniSmartIntelligenceâ¢, looked at the stock markets news and trends.

-

AroniSmartIntelligence⢠and AroniSmartInvest⢠Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks in Late Q1 2024

In Q1 2024, Stocks across industries  experienced, yet an unprecedented upward momentum. The momentum followed the dynamics of Q4 2023, which overtook the challenges at the end of Q3 2023, when all the key market indices, excluding Crude Oil (CL=F) and 10-Yr Bond (^TNX), declined from the top reached  in late July 2023. In Q1 2024, the gains observed in Q4 2023 increased, far outpacing the declines at the end of Q3 2023.  At  the end of Q4  2023 the stocks prices  were on the rise. In Q1 2024 they built on  that momentum. The positive momentum appeared to be driven by the diminishing challenges, which led to the stocks and indices pushing through the beginning of 2024 with a significant improvement in performance.  Hence,  since Q4 2023, the stock market  adjusted to the previous  dynamics that have been leading to increasing market volatility, includinginflation, world events, and other challenges that started in late Q2 2022 and in October 2023.  The US elections in 2024  appear to have a limited  impact on  the dynamics. Hence, the performance  and factors from the end of year 2024 remain the main drivers.  On March 25, 2024, AroniSmart⢠team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ⢠and AroniSmartIntelligenceâ¢, looked at the stock markets news and trends.

-

AroniSmartIntelligence⢠and AroniSmartInvest⢠Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks in Late January 2024

Stocks across industries  have been experiencing an upward momentum  in late Q4 2023.  The dynamics followed the challenges at the end of Q3 2023 , when all the key market indices, excluding Crude Oil (CL=F) and 10-Yr Bond (^TNX), declined from the top reached  in late July 2023. As Q4 2023 started, the declines at the end of Q3 2023 started slowing down. By  the end of Q4  2023 the stocks prices  were on the rise and have been following that trend since then. The positive momentum corresponds to the diminishing challenges, with the stocks and indices pushing through the beginning of 2024 with significant improvement in performance.  Hence,  since Q4 2023, the stock market  adjusted to the previous  dynamics that have been leading to increasing market volatility, includinginflation, world events, and other challenges that started in late Q2 2022 and in October 2023.  The US elections in 2024 are expected to impact  the dynamics, but the performance  and factors from the end of year 2024 remain the main drivers.  On January 25, 2024, AroniSmart⢠team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ⢠and AroniSmartIntelligenceâ¢, looked at the stock markets news and trends.

-

AroniSmartIntelligence⢠and AroniSmartInvest⢠Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks in Mid December 2023

Stocks across industries  have been experienced an upward momentum  in December 2023.  The dynamics followed the challenges at the end of Q3 2023 , when all the key market indices, excluding Crude Oil (CL=F) and 10-Yr Bond (^TNX), declined from the top reached  in late July 2023. As Q4 2023 started, the declines at the end of Q3 2023 started slowing down. By  the second week of December  2023 the stocks prices have been on the rise. The positive momentum correspond to the diminishing challenges, with the stocks and indices pushing through the month  with significant improvement in performances.  Hence,  the stock market appears to adjust to the previous  dynamics that have been leading to increasing market volatility, includinginflation, world events, and other challenges that started in late Q2 2022 and in October 2023.  On December 11, 2023, AroniSmart⢠team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ⢠and AroniSmartIntelligenceâ¢, looked at the stock markets news and trends.

-

AroniSmartIntelligence⢠and AroniSmartInvest⢠Stock Market Sentiment and NLP Analysis: Market Sentiment and Highlighted Stocks in Mid November 2023

Stocks across industries experienced an upward momentum in Q3 2023. At the end of Q3 2023 the stocks faced some challenges, with all the key market indices, excluding Crude Oil (CL=F) and 10-Yr Bond (^TNX), declining from the top reached  in late July 2023. As Q4 2023 started, the declines at the end of Q3 2023 started slowing down. By  mid October  2023 the stocks prices were on the rise. However, the challenges remained, with the stocks and indices ending the month  with a significantdecline in performances. Since then, the stocks indices have been experience strong performances. However,  the stock market appears to  continue facing the previous  dynamics that have been leading to increasing market volatility, includinginflation, world events, and other challenges that started in late Q2 2022 and in October 2023.  On November 12, 2023, AroniSmart⢠team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ⢠and AroniSmartIntelligenceâ¢, looked at the stock markets news and trends.